Retirees Guide to

Gold IRAs & 401Ks

Protect your retirement savings from Inflation

Gold and silver are a great way for investors to diversify their portfolios. Compared to stocks and cryptocurrency, precious metals tend to be more stable and predictable. Historically, gold has retained its value during hard economic times.

Silver tends to be more volatile than gold which means it can be a little more unpredictable. Palladium and platinum are other popular precious metals to add to your portfolio.

Editor’s Pick

Top Gold Investment Companies

To save time, we have listed our top 3 picks for Gold investment options including IRA and 401(k) flexible investment services. Gold has been a valuable commodity for centuries. It has been used as a currency and symbol of wealth and power for many millennia. Since recorded history and beyond it has been found stashed in the graves of the wealthy, or used to adorn furnishings and walls.

This long-standing value demonstrates the stability of precious metals as a global investment that offers stability against risk of future declines. Gold is considered to be one of the safest investments, with its price often recuperating its value quickly through economic downturns or swings in financial markets.

When there is a break in traditional investor confidence, gold prices often go up because investors view it as a safe place to put their money. During inflationary times Gold rises in value and tends to hold against weakening fiat currencies. It is tangible and real.

So what are our Top 3 Gold Investment Picks?

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Integer vehicula mollis purus, eget interdum ex pellentesque ac.

Fees (Maker/Taker)

1.99%*/1.99%

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Integer vehicula mollis purus, eget interdum ex pellentesque ac.

Fees (Maker/Taker)

1.99%*/1.99%

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Integer vehicula mollis purus, eget interdum ex pellentesque ac.

Fees (Maker/Taker)

1.99%*/1.99%

Why Gold and Silver IRA's

Investment Options

Reputation and Experience

American Author and Entrepreneur

"Commodities such as gold and silver have a world market that transcends national borders, politics, religions, and race."

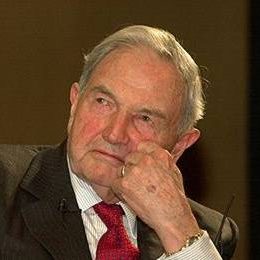

Former Chairman - Federal Reserve

"In the absence of the Gold Standard, there is no way to protect savings from confiscation through inflation. There is no store of value."

British - American Economist

"Those entrapped by the heard instinct are drowned in the deluges of history. But there are always the few who observe, reason, and take precautions, and thus escape the flood. For those few, gold has been the asset of last resort."

John Doe

New York"Lorem ipsum dolor sit amet, consectetur adipiscing elit. Morbi venenatis condimentum tortor sit amet aliquet. Aliquam sed dignissim quam. Curabitur augue nulla, iaculis quis lobortis ut, malesuada id diam. Phasellus egestas orci porta orci euismod ultricies. Nullam sed tortor eu enim cursus laoreet. Ut auctor suscipit augue nec finibus. Cras vel massa turpis. Suspendisse cursus id mi eget vulputate. In interdum in ante eget tincidunt."

William Smith

Florida"Lorem ipsum dolor sit amet, consectetur adipiscing elit. Morbi venenatis condimentum tortor sit amet aliquet. Aliquam sed dignissim quam. Curabitur augue nulla, iaculis quis lobortis ut, malesuada id diam. Phasellus egestas orci porta orci euismod ultricies. Nullam sed tortor eu enim cursus laoreet. Ut auctor suscipit augue nec finibus. Cras vel massa turpis. Suspendisse cursus id mi eget vulputate. In interdum in ante eget tincidunt."

Simple Gold Trading Strategy

A gold trader can make long-term trades based on US Treasury rates or short-term trades based on the seasonality of gold. The trader can utilize technical analysis indicators like moving averages (MAs) to schedule their entry and exit after deciding whether to make a short-term or long-term trade.

Inspiration

Frequently Asked Questions

Learning how to check on the stock market futures could help you predict when you should purchase gold. Hearing that a reserve bank is going to begin printing more currency is also often an indication that the price of gold is about to increase since the value of gold goes up as the value of the national currency goes down.

Free Sign Up Now For Newsletter

Lorem ipsum dolor sit amet, consectetur adipiscing elit morbi venenatis condimentum